At that level of income, this bother is not worth it.

This year, we have seriously muddled the waters by proposing that some can opt to not claim any deductions and pay a lower level of tax. But we persist, and we bring in tokenisms in every Budget. It makes little sense to collect taxes from lower income groups, or to ask them to file laboriously long income tax returns. Both these heads of income have several concessions that reduce the effective tax outgo.

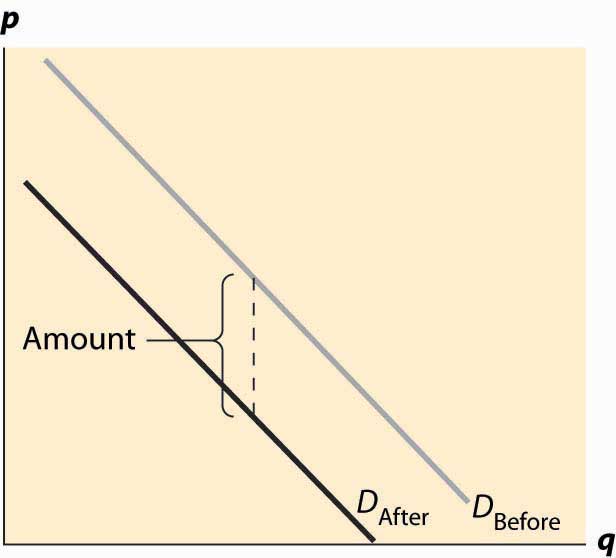

#The imposition of a tax on a good enables the government to generator

Reduction of CST rate first from 4% to 3% & then from 3% to 2% has been done as a precursor to the introduction of Goods & Services Tax (GST), as CST would be inconsistent with the concept & design of GST.TomorrowMakers P2P Data Center Fuel Rates Diesel Rates Petrol Rates Bank Pan Number Bank holidays Penny Stocks MF Ratings & NAV Top Performing Schemes Top Star Rated Schemes Top Tax Saving Schemes Highest Risk Adjusted Return New Fund Offers Forthcoming Dividends NPS Top Performing NPS Scheme Most Consistent NPS schemes ETF Perfomance Latest Prices Listed Bonds Traded in Cash Market ULIPs ULIP Schemes Calculators Recurring Deposit Calculator Fixed Deposit Calculator LTCG Tax Calculator Income Tax Calculator Rent Receipt Generator SIP Planner Tool IFSC Bank Code NPS Calculator Invoice Generator EPF Calculator House Property Income HRA Calculator Sukanya Samriddhi Calculator Education Loan Calculator Car Loan Calculator Home Loan Calculator Personal Loan Calculator Risk Tolerance Calculator Financial Fitness Calculator Buy Online Health Insurance Car Insurance 2 Wheeler Insurance Interest Rates Recurring Deposit Rates Fixed Deposit Rates Bank Fixed Deposits Rates Post Office Schemes Rates MCLR Loan EMI Participate & Win Stocks & Shares ET Wealth ET Wealth Editions Buy Wealth Magazine ET Wealth NewsletterĮxcept for those who earn a salary income and are subject to TDS, there are few, if any, instances of higher income earners paying a high proportion of income as taxes.Īs one moves up the wealth ladder, incomes arise primarily from business or profession or from capital gains. After this amendment, the rate of CST on inter-State sales to Government will be same as VAT/ State sales tax rate.Ĭentral Sales Tax rate has been further reduced from 3% to 2% with effect from 1st June, 2008. Through this amendment, facility of inter-State purchases by Government Departments at concessional CST rate, against Form-D has been withdrawn. An amendment to the Central Sales Tax Act to provide for reduction of the rate of Central Sales Tax for inter-State sales between registered dealers from 4% to 3% w.e.f. The Act excludes taxation of imports and exports.ĬST being an origin based tax, is inconsistent with Value Added Tax which is a destination based tax with inherent input tax credit refund.

The entire revenue accruing under levy of CST is collected and kept by the State in which the sale originates. The CST Act, 1956 Act provides for declaration of certain goods to be of special importance in inter-State trade or commerce and lay down restrictions on the taxation of such items. Originally, the rate of CST was 1%, which was increased first to 2%, then to 3% and w.e.f. This amendment also authorized Parliament to formulate principles for determining when a sale or purchase takes place in the course of inter-State trade or commerce or in the course of export or import or outside a State.Īccordingly the Central Sales Tax (CST) Act, 1956 was enacted which came into force on.

a) Taxes on sales or purchases of goods in the course of inter-State trade or commerce were brought expressly within the purview of the legislative jurisdiction of Parliament ī) Restrictions could be imposed on the powers of State legislatures with respect to the levy of taxes on the sale or purchase of goods within the State where the goods are of special importance in inter-State trade or commerce.Certain amendments were made in the Constitution through the Constitution (Sixth Amendment) Act, 1956 whereby.Narcotics Drugs & Psychotropic Substance.

0 kommentar(er)

0 kommentar(er)